Bust a CAPA

Colter pulled a hamstring during this press conference

If you hadn’t heard, Northwestern’s football players won a court thingy yesterday. NLRB Regional Director Peter Sung Ohr ruled that Northwestern’s players meet the definition of employees, and can therefore form a union if they wish. You can read the ruling here, but why do that when I can summarize it for you with amusing banter?

Bring in the inquisitive bolded alter-ego!

Hey, you can’t tell me what to do. You’re not my boss.

Well that’s the question, isn’t it?

God you are insufferable. Okay, fine. I’ll play your game. GEE WHIZ, WHAT HAPPENED?

Well, to understand fully, we need to go back to 1935…

/sigh

…when Congress passed the National Labor Relations Act. Under the NLRA, private sector employees have the right to join unions and to collectively bargain for stuff like wages, salary, better candy in the vending machines, and for the boss to stop using words like “synergy” and “Tiger Team.” The catch is that it only applies to employees. The NLRA, for example, doesn’t give students the right to form a union. A person is an “employee” if they perform services in exchange for payment, and are under that person’s control. What the NLRB regional board ruled was that Northwestern’s players do football stuff for Northwestern, as directed by Northwestern* (in the form of the coaches), and in return are compensated with a scholarship and things. In short, Northwestern’s football players are employees of the University.

|

| Kind of. |

*other than the defensive secondary, which the NLRB noted “did not seem to understand what a ‘deep half’ was supposed to look like, and displayed an utter disregard for the coaches’ directions to, quote, ‘just look for the other color jersey and guard someone, anyone, goddammit.’”

But the players aren’t paid. They just got to go to school for free and eat some free food and stuff. How are they any different than a normal scholarship student who does biology things the way the biology department says?

That was the University’s main argument. They claimed that the players were more like Graduate Assistants, who aren’t considered employees under a previous NLRB decision (Brown University, 342 NLRB 483 (2004)). The court said that the difference was that GAs aren’t employees because their relationship to their various universities is primarily educational. In other words, your PoliSci GA is simultaneously teaching and studying PoliSci, so they don’t count him as an employee for the teaching part.

The ‘work’done by football players, on the other hand, is completely unrelated to the educational mission of the school and to the athletes’ studies. The university doesn’t get any educational advancement from what football players do (though Northwestern seriously tried to make the argument that playing sports enriches the student experience, and sports are therefore educational, which is exactly as bad of an argument as it sounds).

Instead the school receives gigantic piles of money from what football players do. The school’s interest is economic, not educational. Moreover, they said that the players are not “primarily students,” as they spend up to 50-60 hours per week** on football duties.

Cool to see so many people excited about education

**Real hours. No one other than the NCAA gives a flying crap about the hilarious differentiation between “countable hours” and “non-countable hours.” Mike Rosenberg still sucks.

[AFTER THE JUMP: More union talk. Plus a Sad Pat Fitzgerald GIF]

So who does this affect?

Not as many people as you might think.

- We’re just talking about football players = This doesn’t automatically make the Northwestern Swimmers Local 113 a thing. The way the ruling is written, it’s pretty clearly limited to football for now.

- Walk-ons aren’t people – Okay, they might be ‘people.’ But because they aren’t compensated the same way scholarship athletes are, because they have more flexibility than scholarship athletes, and because they don’t sign a tender, they aren’t covered by this ruling. You may continue to throw mud on them.

- This only applies to private schools – If you were paying attention above in the boring legal section, the NLRA only applies to private employers. Public school athletes are covered by various state laws regarding public sector employees.

So cut to the chase: how much are Northwestern players going to get paid now? And what IS the going rate for the run-of-the-mill Unstoppable Throw God?

We’re like 31 steps from there. This isn’t a ruling that gets players paid. It isn’t a ruling that changes anything about the game or the player obligations or team rules or jerseys. It doesn’t even create a union at Northwestern. All it does is declare that Northwestern players CAN form a union, and that the union (if created) will be empowered to negotiate on behalf of the players.

This isn’t about pay-for-play. CAPA has listed its goals, which consist of:

|

| You’ve gotta diversify your bonds. |

- Improved medical coverage;

- Protecting player brains and whatnot;

- Improving graduation rates;

- Allow players to commercially exploit their own likenesses if/when the NCAA removes the stick from its institutional rectum; and

- Improving due process rights for rule violation punishments.

Notably missing are “cash rules everything around me,” “get the money,” and “dollar dollar bill y’all.”

But this breaks college sports into a billion tiny pieces, each no larger than Tom Izzo, right?

According to the NCAA, yes. According to logic, shut the hell up NCAA.

First, despite the fact that it has become a Key and Peele parody of an SNL parody of itself, the NCAA continues to exist, and its eligibility rules are still in place. If CAPA formed a union tomorrow and demanded that Northwestern pay them an additional 7 cents per hour, the players would become ineligible. Now, granted, the NCAA has mountains of its own legal troubles already, but the nature of the interaction between Northwestern and its athletes is completely detached from the NCAA.

Some (including John Infante) have wondered whether this would put either schools’ or the NCAA’s non-profit/tax exempt status in jeopardy, but I don’t think so. Non-profits can have employees, and they can do things that make money. The vast majority of sports would still be amateur, so I don’t think it’s a problem.

Of course, the NCAA came out with one of their usual “holy shit you actually pay these people to communicate with the public for you on purpose” statements in response to the ruling (which has been appropriately fisked by Sippin on Purple). They continue to conflate the issues of athlete pay with athlete negotiating rights, because John Q. Fan doesn’t think college athletes should be paid, but is generally okay with athletes jointly deciding to try to avoid rhabdo and concussions a little bit.

These guy, man.

Doesn’t this mean that scholarships are going to be taxed?

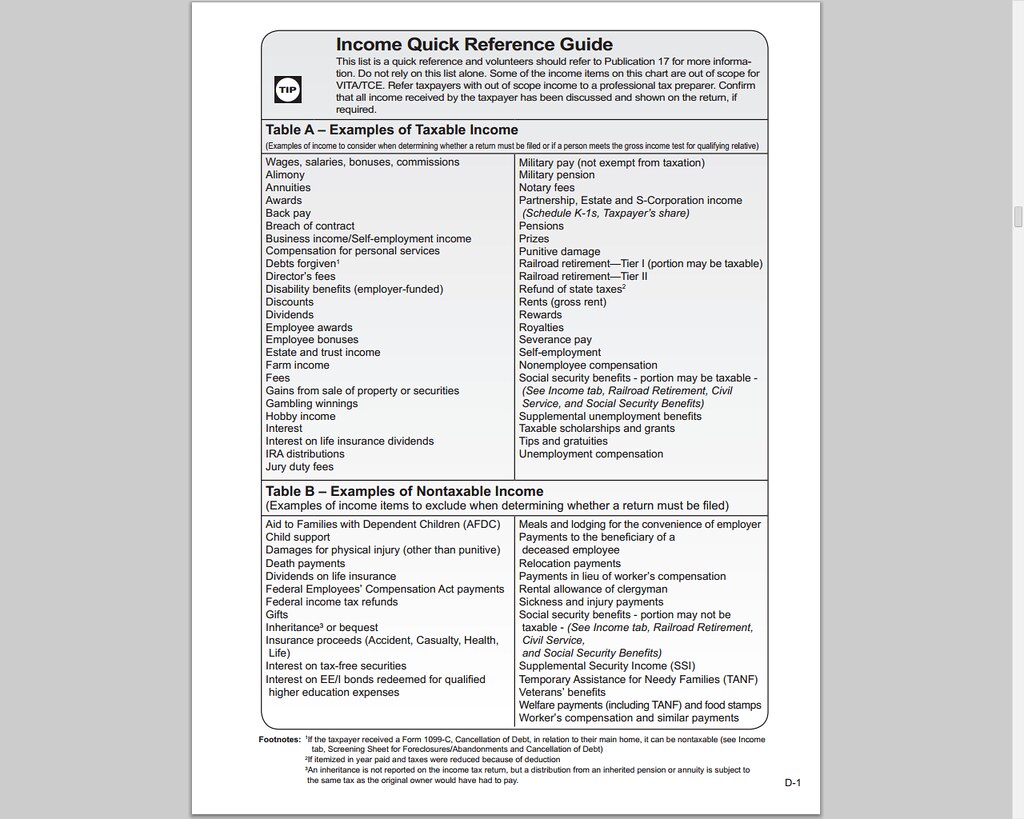

Maybe. Probably not. But definitely not right now. Multiple tax experts have given different answers to this question, and I am not a tax lawyer. But I did stay at a Holiday Inn Express once, and without going too deep in the weeds, the IRS decided a long time ago that it was not going to tax athletic scholarships. IRS Revenue Ruling 77-263 states that athletic scholarships are excluded from gross income.

If the Universities and the newly-unionized players don’t make any significant changes to the compensation structure, there is no reason to expect the IRS to change its stance. You see, the IRS doesn’t much give a Chipotle-induced crap about what the NLRB says, and the NLRB couldn’t care less about how people treat income for tax purposes. One of the first things you learn in labor law is that an employee is an employee whether you label them an “employee,” a “student-athlete,” a “compensated volunteer,” or "haberdasher's apprentice." It is the facts that control, not the labels.

|

| Generic taxation picture |

Plus, here’s the kicker: under Rev. Rul. 77-263, athletic scholarships are taxable if they can be withdrawn by the universities in the event the athlete quits his chosen sport. So, on a plain text reading, athletes should be paying taxes RIGHT NOW. If Brady Hoke can pull a scholarship from a kid who decides to quit football (and I think that’s a pretty safe bet), Michigan football players should already be counting their scholarships as income. But one thing a union can potentially do is get the school to enforce its four year guaranteed scholarship authorized by the NCAA, which WOULD bring them back within the tax-free zone.

Like I said, weeds. But the bottom line is that the people who set and interpret the tax code are subject to political pressure. They aren’t going to put themselves out there as the monsters who obliterated college football over a tiny tiny tiny amount of tax revenue. It’s a theoretical risk, not a practical one.

I’ve gotta ask: what is the big deal?

The practical effects are interesting and could potentially affect a few parts of the athlete/university relationship. But for me, the bigger issue is a more fundamental one.

People have asked why the NLRB thinks athletes should be employees, and that’s a fundamental misunderstanding of the process. The NLRB isn’t saying football players should be treated like employees. They’re saying that football players ARE employees. The NCAA has been hiding for years behind the theory that because these kids are “student-athletes” (a term the NCAA made up to avoid liability), the normal rules don’t apply.

Yesterday’s ruling was a pretty clear indication that those arguments are crap. You have an industry that makes huge amounts of money. You have a labor force that is highly skilled, drawn from a very narrow pool, and that spends more than a full time job worth of time on the job. The company’s income is largely based on the performance of the workers. They are under the complete (and damn-near dictatorial) control of their supervisors. And they are compensated to the tune of $50,000 to $75,000. And you ask people to believe they aren’t employees because you created a useful fiction that lets everyone sleep better at night? Shove it, sir. Shove it hard. When you see the facts on paper, it’s impossible to reach any other conclusion without adding some external consideration; “but think of what it will do to the game?”

We tend to let a lot of things slide because we love sports so much. We like physical sports, so law enforcement doesn’t get involved when a player comes up behind a guy from behind, knocks him out cold, and whacks him in the neck with five foot long wooden stick in front of 6,000 witnesses. We enjoy the NCAA football video games, so we played along with the amusing theory that Michigan’s quarterback just happened to wear the same #16 the stores happened to be selling for a few years. We even try to talk ourselves into the idea that maybe football isn’t as dangerous as it’s being made out to be. But with yesterday’s ruling, at least we can say that the legal system can still see through Mark Emmert’s steaming fiction.

What happens now?

Northwestern will almost certainly appeal the ruling to the full NLRB, and I don’t have a clue what happens there. Lester Munson seems pretty confident the ruling will stand, but a labor attorney friend of mine was more skeptical and pointed out that the NLRB doesn’t like rocking the boat, so who knows. In the meantime, the players can vote immediately on whether to form a union. Only the currently-enrolled scholarship athletes are eligible to vote.

Can we get the promised Sad Pat Fitzgerald GIF?

It is because I am right. And very handsome. And an above-average Scrabble player.

You'll have to ask him for sure, but I don't think Ace has ever thought "I was going to have this difference of opinion but since SETH is against it..."

I'm flattered you think so.

Maybe because I could kick his ass?*

*in NCAA '14

March 27th, 2014 at 10:57 AM ^

Can you fire employees for not performing well at their job? Asking for a friend in Alabama.

EDIT: But seriously, can you?

March 27th, 2014 at 10:58 AM ^

Interesting question.

In any event, being declared employees means paying income taxes, which might make it not that great a deal for the student-athletes.

March 27th, 2014 at 11:03 AM ^

Read the part about the taxes. I'm not 100% sure about my analysis, but I think it's pretty solid.

March 27th, 2014 at 11:15 AM ^

The scholarship could be tax-free - but that could change if the legal status of athletes changes. And I would assume that any additional compensation that players might want would be taxable, and the freebies they get now (all the gear, bowl trickets and whatnot) probably would be as well.

March 27th, 2014 at 11:17 AM ^

Well there's technically taxable and there's realistically going to be taxed, and those are different things. All of this should be taxable, but find me 250 congressional districts in these United States that will elect a candidate with "he taxed football!" hanging around his neck.

The IRS has to bow to political pressure, and for such meager sums there are only a bare handful of politicians who would pass up the opportunity to give those sums away to win points with football fans.

March 27th, 2014 at 11:21 AM ^

Besides, the effective tax rate on even $10,000 of income are really, really small.

March 27th, 2014 at 11:46 AM ^

Social security and medicare taxes are not that tiny.

March 27th, 2014 at 11:54 AM ^

FICA is 7.65% (I think?), but at $765 dollars most schools could afford a gross-up that would cover most of that without a problem. Heck, they're looking at a $2,000 stipend right now.

And if that's the worst case scenario, it's MUCH more reasonable than full taxation on $75,000 of income, which would be, what, $15,000?

I am not comfortable with the idea of something technically being taxable but just trusting that the IRS will look the other way and not enforce it for the sake of political expediency. That leaves way too much power in the hands of the bureaucrats, political pressure notwithstanding. Also, whether something is or is not taxable should not be something that can shift with the political winds, without an actual change in formal regulations. Anything else and the rule of law suffers.

It's more of a matter of there being a bazillion potential debates over taxable income nation-wide, and the IRS only addressing the material ones.

If you're the IRS, are you going to waste time on this when there are so many other issues that involve greater amounts of money and people who are much more deserving targets of scrutiny than a bunch of college students? Almost certainly not.

March 27th, 2014 at 11:12 AM ^

March 27th, 2014 at 11:16 AM ^

Nothing about the nature of the work is changing, and nothing material about the nature of the compensation is changing. They remain students, and they are still receiving money going toward education. The fact that the NLRB might consider those facts to be an employee arrangement does not necessarily mean the IRS will follow suit, and unless something about the factual nature of the relationship changes, I really doubt they will.

March 27th, 2014 at 11:35 AM ^

The basis for the IRS's decision was based on the destinction between "student" and "employee" as it was previously understood. Now that the destinction has been erased with respect to football players at private universities, I wonder whether the IRS will change its stand.

Moreover, a ruling by a Federal agency can have broad implications (e.g. the impact of Dodd-Frank based on SEC implementation of the law isn't just affecting banks and investing and whatnot, but rather every company required to make SEC filings). So, while the NLRB ruling only applies to the aforementioned, an IRS ruling may eventually affect all scholarship athletes at all universities, public or private.

March 27th, 2014 at 11:48 AM ^

And it would affect all scholarship football players, public and private. They certainly CAN revisit their position in light of this ruling. But the same was true last week, and they didn't. The IRS has to affirmatively go after people, and they have been historically very generous (or at least non-dickish) when we're talking about scholarship money that goes directly to schoolin' stuff. These ARE still scholarships (players can't take them in cash or Starbucks gift cards instead).

Given the tiny amount of revenue involved and the epic shit-storm it would create, I just don't see it happening.

March 27th, 2014 at 11:54 AM ^

Don't the players get a monthly stipend that is cach/check that they use to pay for rent, clothes, late night pizza, etc.?

March 27th, 2014 at 11:58 AM ^

But theoretically they have to pay taxes on some stuff they receive, and don't. The IRS just doesn't much care.

It's like the Use tax. In theory, if you buy stuff from out-of-state on Amazon, you have to declare it on your state taxes and pay the sales tax on those items. A tiny fraction of people do that, and no one cares because it's a rounding error on a rounding error to the government. There is at least a touch of pragmatism with stuff like this.

March 27th, 2014 at 12:55 PM ^

No one careas about the use tax?

Michigan estimates they lose about $500 million per year in sales tax due to internet sales.

...and the US Congress and other states care so little that there have been repeated attempts to extend sales tax to online purchases, and the House Judiciary Committee just met about it a couple weeks ago.

March 27th, 2014 at 11:57 AM ^

and with a more nuanced argument to boot. You are on your game, BiSB

But moreso on the shit storm point. Some years ago, the IRS proposed taxing as earned income the frequent travel points earned by road warriors like myself. Even though they could not (at the time) be converted to cash (but rather a discount against future travel expenses) the IRS saw it as fair game.

The excrement commenced flying and the IRS backed off.

They backed off - but left the potential for future taxation in place... and if you provided "information" to get the reward it IS taxable:

"In 2002, the Internal Revenue Service announced that it would not pursue the question of whether frequent flyer miles, and rewards and other promotional discounts awarded by credit card companies to cardholders. This position was made public in Announcement 2002-18.

The IRS further explains in Publication 17 that rewards are taxable only if you provided information in exchange for the reward, "If you receive a reward for providing information, include it in your income."

March 27th, 2014 at 11:49 AM ^

The distinction between student and employee that was erased here was erased by the Chicago section of the NLRB. That, while perhaps persuasive for purposes of IRS decision making (though given the reasons outlined in the piece as written by BiSB, I would think the IRS probably wouldn't be persuaded), does not create a distinction that the IRS needs to follow.

March 27th, 2014 at 11:22 AM ^

March 27th, 2014 at 12:48 PM ^

will union dues come? Will players, or their parents, have to pay those out of pocket? Will walk-ons benefit from collective bargaining? If not, what will be the incentive for a walk-on as he sees his position on the team pushed even further down the pecking order? Does anybody seriously believe a player's union will allow the use of walk-ons on game day?

March 27th, 2014 at 11:11 AM ^

How can you be considered an employee and not be earning taxable income? Becuase the law as it is written now specifically exempts athletic scholarships from taxation. SO then...they're unpaid employees? Well, that's not true either.

There's lots of interesting details with this that will need to be ironed out. Assuming that the ruling is upheld through the various appeals processes and higher courts, of course. I wonder if it gets there...would the Supreme Court hear such a case?

March 27th, 2014 at 11:55 AM ^

I don't think it's unreasonable to think that they can be employees and have their scholarship still be tax-free. Sure, it's a unique situation, but this seems within the realm of reason, for sure.

Now, if there are any other changes, such as athletes profiting from their likeness (which have been discussed), player stipends increasing (which has been discussed for a couple years now) or any other method of paying players, then I would think that would almost certainly be taxable.

March 27th, 2014 at 11:55 AM ^

They are employees. They do receive compensation (income). It is just that the income is not taxable because the Treasury Department believes that Congress made it that way. It may be unusual, but it's not unprecedented. For example, IRC Sec 112 exempts certain combat pay from gross income - which makes it exempt from tax.

So, they are employees, they are paid, they do have income, but the income is not subject to tax, according to the people responsible for interpreting such things. It's not really a big deal.

March 27th, 2014 at 12:17 PM ^

If the only other exemption is combat pay then these athletes need to pay income tax. Playing a college sport may be a unique situation but it in no way compares with combat military service and should not be given the same privileges. If they want to be considered employees to recieve all the benefits that go along with that such as increased bargaining power, possibly increased pay etc then they should have to deal with all the same things that other employees deal with. That means paying income tax , social security medicare etc.

Combat pay is not the only exemption to income tax. It is a rare exemption that makes a cash bonus (not a reimbursement) paid to an employee non-taxable though. Anything of value that you receive is income. If someboy gives you $5 for your birthday, it is $5 of income. It is not taxable income because it is under the limit for gifts. If you trade somebody your $50 video game for an $80 blu-ray player you just made $30 of income. That is taxable (although you won't report it and there is virtually no way to catch you).

A large part (perhaps the majority) of the IRS tax code is deciding what different forms of income count as and whether they are taxable or not (and what form of taxation they will fall under). Here is a handy chart that gives a small slice of the taxable vs non-taxable discussion:

The IRS also publishes a "short" 36 page document that gives an overview for many (but far from all) scenarios of income. In fact, in this Publication 525 (http://www.irs.gov/pub/irs-pdf/p525.pdf) it explicitly says the tuition payment will not be taxable to an employee

You can exclude a qualified tuition reduction from your income. This is the amount of a reduction in tuition:

- For education (below graduate level) furnished by an educational institution to an employee, former employee who retired or became disabled, or his or her spouse and dependent children.

- For education furnished to a graduate student at an educational institution if the graduate student is engaged in teaching or research activities for that institution.

This argument will only apply to undergraduate student-athletes but I think BiSB's logic is correct that the tuition payments would not be taxable for 5th year graduate students either. But even if you don't believe him, there are numerous ways to avoid taxation. For example, the University could set up a tax-free "529 plan" and contribute the tuition and room & board amount to that account. The athlete would then "pay" tuition from that account that Uncle Michigan (I mean University of Michigan) generously contributed to.

March 27th, 2014 at 11:51 AM ^

If partaking in education simply became a requirement of the athletes job, it's no longer a scholarship and its no longer taxable income. It would be no different than when my employer provides inhouse continuing education opportunities that I have to complete to remain licensed. Those inhouse continuing ed. classes are not taxed.

That's just an example of ways around the tax thing. If players were suddenly treated like the employees they are, schools would figure out a way to make their taxable income as low as possible so that they would have to put forth less real money to pay the athletes.

March 27th, 2014 at 10:59 AM ^

Being part of a union makes the athletes unionized and therefore NOT at-will employees. So were athletes at-will employees? If so, they could be "fired" for any reason or no reason at all.

March 27th, 2014 at 11:04 AM ^

I would think the answer is "no" since the NLRB ruling wouldn't affect most of the NCAA scholarship rules, so long as the amateurism concept is left intact.

March 27th, 2014 at 11:57 AM ^

And there's still the PR aspect. If a coach says, "you're an employee now so I can fire you whenever I want," other coaches will certainly use that against him in recruiting. Even now, there are things that teams "can" do but don't because kids would be less likely to jump on board if they did.

March 27th, 2014 at 12:10 PM ^

I don't think we'd see coaches coming out and telling a player they are 'fired'. However, there are coaches today who oversign and manipulate the system such that players are let go from scholarships so the program can get down to the 85 alloted scholarships. Miles and Saban being the most prominent. What the other poster says would mean these coaches would no longer need to manipulate the system, they'd be free of any wrong doing by releasing players. Now, I'm sure the coaches would come up with some sort of description other then the 'player was fired' because they wouldn't want to be known as a coach who 'fires' their players.

PLayers already can be "fired" or have their scholarship pulled for any reason the coach deems fit. The NCAA has tried to put some measures in place to dissuade them from doing it, but there isn't anything anywhere that says Brady Hoke couldn't pull someone's scholarship if he felt like it.

CAPA is looking for a way to negotiate AWAY from that being possible.

March 27th, 2014 at 10:57 AM ^

But seriously, even though it may be '31 steps away' the consequences of this are far, far reaching. Will it mean the end to scholarship athletic sports? Probably not. But it's naïve to think things won't change drastically down the road.

March 27th, 2014 at 11:06 AM ^

It was predictable that the immediate reactions would mostly go overboard regarding the implications of the ruling. I'd like to add that it's easy to forget that Maurice Clarett started with a victory in his suit against the NFL. This may well turn out the same way. A key difference is that the NCAA may, and hopefully will, give the players what they're asking for in the meantime.

March 27th, 2014 at 11:42 AM ^

March 27th, 2014 at 12:04 PM ^

I very much doubt this would be the cause. These players haven't been asking for anything that would cost that much.

Players getting paid would have far-reaching implications. The lawsuit filed by Kessler and the O'Bannon suit are the vehicles that are much more likely to lead to that.

March 27th, 2014 at 11:13 AM ^

OK, someone who knows how to use the stats databases should really look up where that punt stands in the scheme of things: what is the closest to opponent's goalline starting field position on an unreturned punt? That one has to rank as one of the closest... although I'm sure someone has probably shanked one almost perftectly sideways at one time or another.

Aside from the punt gif, very interesting piece, thanks for putting it together!

March 27th, 2014 at 11:32 AM ^

...what's the ugliest possession ever after that bad a punt? sigh

March 27th, 2014 at 11:19 AM ^

Regarding Rev. Rul. 77-263, I think the scholarships are given on an annual basis, and I don't think Brady Hoke can pull a scholarship mid season. He can just choose to not renew next season.

March 27th, 2014 at 11:20 AM ^

Hadn't thought of whether those apply on a year-to-year basis, or on the whole. They probably can't revoke a scholarship mid-term, but they probably can do so from year-to-year. The ruling doesn't really specify which they meant.

March 27th, 2014 at 11:16 AM ^

Lots of luck getting management to stop using those terms. There are more consultants (which I'm) than there are attorneys negotiating labor agreements. For every "Tiger Team" and "Synergy" you legal eagles identify and codify out of the corporate lexicon, I've got 10 more in my "core competency" to "empower" the "bleeding edge".

March 27th, 2014 at 11:19 AM ^

no unions please KTHXBYE

March 27th, 2014 at 11:20 AM ^

March 27th, 2014 at 11:21 AM ^

I'm glad you pointed to that 2004 NLRB decision regarding graduate assistants at Brown, because it is important to note that that decision was a reversal of a previous reversal. In other words, we cannot predict how this will pan out in the end because the NLRB tends to be highly inconsistent and at times unduly influenced by the prevailing politics of the time.

Which also happens to be true of the Supreme Court, where this may be headed unless Congress steps and legislates an answer. Since the latter is unlikely given the inability of the current Congress to get much of anything done, we have to wonder what might happen if either side is inclined to appeal this all the way to the Court. The current Court would no doubt overturn this decision.

But I think that also is going too far. As you point out, many of the complaints, predictions, etc. are based in the weeds, and we are nowhere near there. And much of the screaming is around NCAA rules, where the NCAA is not the employer but rather a trade association. The athletes would have to unionize first, then challenge the conditions under which NCAA rules force them to work, wait for Northwestern to respond then sue both the NCAA and NU. That is way, way down the road.

I think during the upcoming appeals process, if they get the sense that the decision will stand, the NCAA and Northwestern as well as other private universities are likely to consider the possibility of negotiating a very limited CBA addressing the few issues that CAPA claims are its main concerns. That will be potentially expensive, and some smaller schools may eventually decide to drop down to D3, but this too is just conjecture far off in the future.

And thanks for pointing out that tax issues are completely separate and have never gotten in the way of higher education funding scholarships. The IRS has bigger fish to fry and is has long been generous in its definition of non-taxable benefits to full-time students, including tuition waivers. Stipends are another thing, that was a big change for UofM TA's and RA's back in the late 80s, they had to be treated as wages, but that's sensible and a minor piece that doesn't even apply now to athletes. It may, eventually, if the rules get bent to allow larger stipends to cover living expenses.

March 27th, 2014 at 11:21 AM ^

For what it's worth, it's pretty broadly thought that the current NLRB is going to eviscerate the 2004 Brown ruling (related to whether grad assistants are employees or apprentices) the minute it comes before the board. That ruling was itself a reversal of a ruling by the Clinton era NLRB that grad assistants were employees.

NYU recently agreed to recognize and bargain with their graduate student union (itself a local of the UAW) in an effort to keep the Brown ruling from going before the current NLRB. They, in effect, took one for the private university team in an effort to prevent broadscale organizing of graduate students at private institutions.

http://www.insidehighered.com/news/2013/11/27/nyu-and-uaw-agree-terms-e…

Comments